So, at 17, I decided it was time to “grow up” – I left school and got a $1.65 an hour job working in a shipping department loading and unloading trucks. I hated that job as much as I hated school. It was boring. A menial job that was a waste of my time and my life.

One day when I was 19, my brother called and asked me if I would be open to meeting a very successful entrepreneur, who he thought might be able to help me stop getting into trouble.

After learning a bit more about this man, I said yes and several weeks later, I took the train from Montreal to Toronto to have lunch with Mr Alan Brown. At lunch, he asked me a series of questions about what I wanted to achieve in my life.

My answers were typical for a 19-year-old. I told him that I wanted my own car, to move out of my parents house and to get a better paying job.

“That’s a good start, son,” Mr. Brown said. “But what are your bigger goals and dreams?”

I stared at him, Bigger goals and dreams? I don’t have any!

He reached into his briefcase and handed me the 1980 Goal Setting Guide and instructed me to fill it out and to “dream big”. I obliged.

- What age do you want to retire? Retire? I was 19! Um… 45!

- How much net worth do you want to have? Net worth? I don’t even know what that means. Um… $3 million!

- What kind of lifestyle do you want to live? I want to drive a Mercedes Benz and live like the people on the tv show, “Lifestyles of the Rich and Famous” in a big 4-bedroom house with a 3 car garage.

I want to help my parents retire. I want to travel the world first class and have an Italian wardrobe were a few of the things I wrote.

At the time, it felt like utter ridiculousness and stupid to write down all the “dreams” I had. It was so scary and also, so liberating at the same time!

After Mr. Brown read what I wrote, he smiled and then…

He asked me the question that would change the entire trajectory of my life.

“Son, he said…are you interested in achieving these goals or are you committed to achieving them?”

What? Am I interested or am I committed? “Mr. Brown,” I replied. “What’s the difference?”

“Interested people do what is easy and convenient,'' he said. They allow their reasons, stories, excuses, and mindset to keep them stuck repeating the same actions and results over and over again.

Committed people upgrade their identity to match the destiny they want. They upgrade their beliefs, their habits and their skills to match the goals and dreams they are committed to achieving. ”Then he said… They do whatever it takes.

WOW I thought! “In that case, I’M COMMITTED!”

That’s the day my life turned around and everything changed for me. That day, I went from being a victim with a whole bunch of stories and excuses to a hopeful young man committed to achieving my goals and dreams.

I went from a kid who was voted “Most Likely to Fail” to a man on a mission.

How? By being committed to upgrading my mindset. My skill set and my actionsets.

One man. One question. and One Answer that led to a relentless focus on how-I-can-and-will instead of why-I-can’t-or-won’t. This is what changed everything for me.

So now, I ask you: Are you interested in achieving your life’s biggest goals and dreams or are you committed to achieving them?

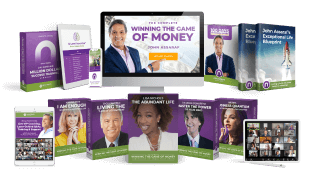

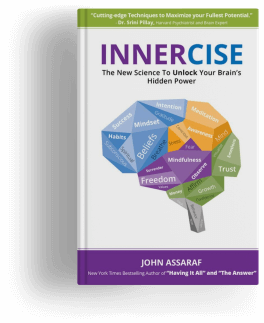

I have helped millions of people through my New York Times bestselling books, magazine articles, 11 movies and innumerable interviews. Hundreds of thousands of clients have used my powerful brain-training and coaching programs to overcome their mindset and lack-of-skill obstacles to catapult their lives to the success they only dreamed of.

Today, my purpose is to take all my lessons. My research. My methods, techniques and proven strategies, and show you exactly how you too, can have the life of your dreams…faster and easier than you ever thought possible.

I hope I can be of service to you.

Are you interested or are you committed?

With Love,

John Assaraf